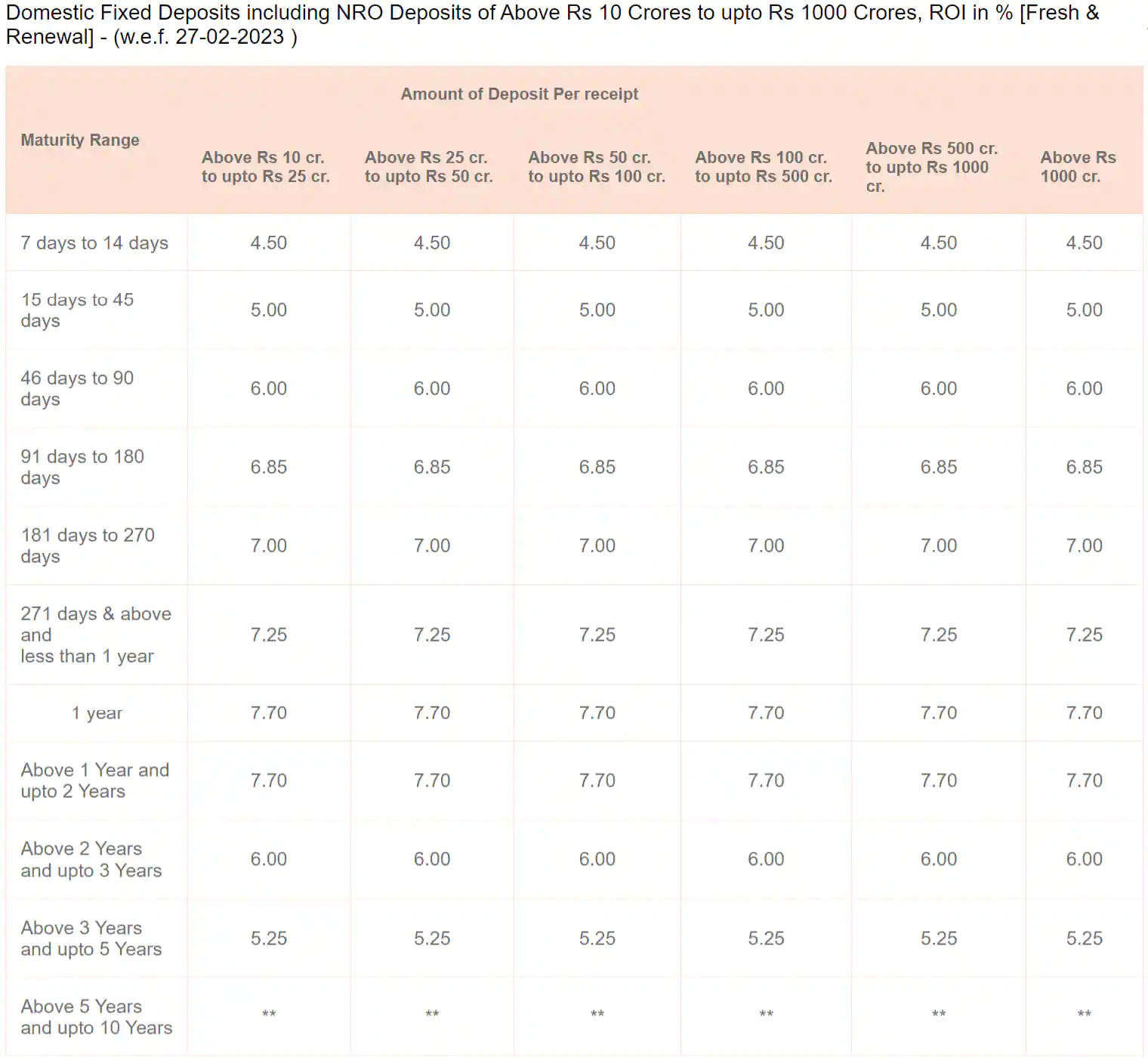

BoB Bulk FD Rates: Bank of Baroda (BoB), a public sector lender, raised interest rates on bulk domestic fixed deposits, including NRO deposits of more than ₹10 crore, to up to ₹1000 crore. After the adjustment, the bank is now providing interest rates on deposit tenors ranging from 7 days to 5 years that range from 4.50% to 5.25%. For bulk fixed deposits maturing in one to two years, BoB will now provide a maximum interest rate of 7.70%. The bank’s official website states that as of February 27, 2023, the revised bulk fixed deposit interest rates are in effect.

BoB Bulk FD Rates

On bulk fixed deposits maturing in 7 days to 14 days the bank is offering an interest rate of 4.50% and on those maturing in 15 days to 45 days, Bank of Baroda (BoB) is now promising an interest rate of 5.00%. Bank of Baroda (BoB) is now promising an interest rate of 6.00% on a deposit tenor of 46 days to 90 days and an interest rate of 6.85% on a deposit tenor of 91 days to 180 days.

Bulk fixed deposits maturing in 181 days to 270 days will now fetch an interest rate of 7% and those maturing in 271 days & above and less than 1 year will now fetch an interest rate of 7.25%. On bulk fixed deposits maturing in 1 year to 2 years, the bank is offering an interest rate of 7.70% and on those maturing from above 2 years and upto 3 years, BoB is now offering an interest rate of 6.00%. Deposits maturing from above 3 years and upto 5 years will now fetch an interest rate of 5.25% at Bank of Baroda.

Bank of Baroda also hiked interest rates on Baroda Advantage fixed deposit (Domestic) accounts of above Rs. 10 crores to upto Rs.1000 Crores. On a deposit tenor of 1 year to 2 years, the bank is offering an interest rate of 7.80% and on those maturing from above 2 years and upto 3 years, BoB is offering an interest rate of 6.10%. BoB is offering an interest rate of 5.35% on Baroda Advantage fixed deposits maturing from above 3 years and upto 5 years.

“In case, the customer wishes to make changes in the tenure or wants premature proceeds of the Term deposit, the same is allowed at the written request of the customer. In case of deposits under callable scheme premature withdrawal of bulk deposit is done as per Bank’s discretion,” mentioned Bank of Baroda on its website.