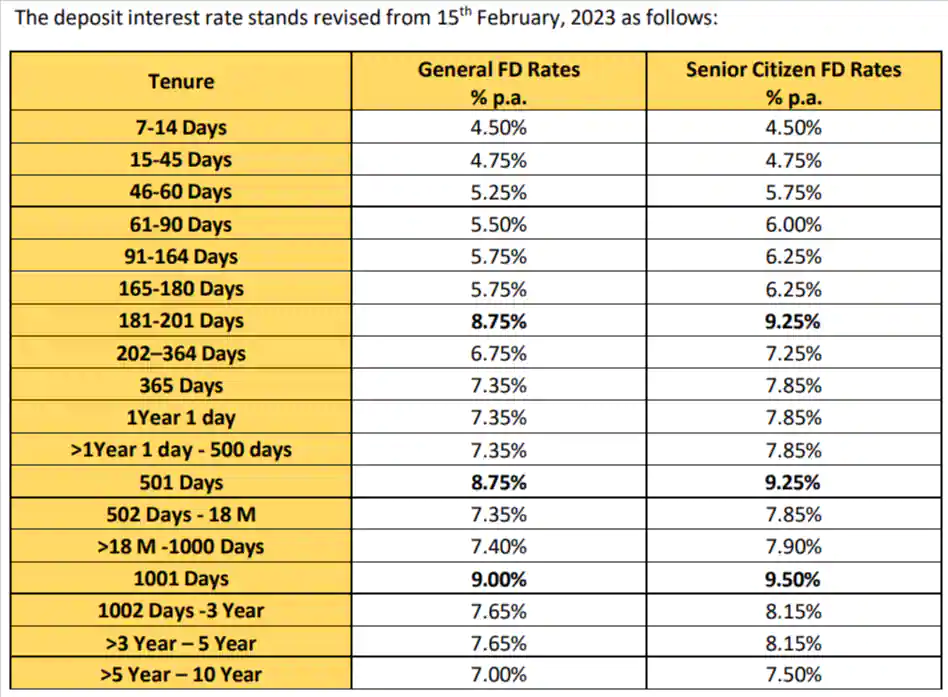

Unity Small Finance Bank Limited (Unity Bank) has increased its interest rates on fixed deposits of less than ₹2 Cr. The latest fixed deposit interest rates are in effect as of February 15, 2023, according to a bank statement. Customers can now take advantage of the high-interest rate regime among the banks since Unity Small Finance Bank is now offering senior citizens an attractive rate of 9.50% p.a. on fixed deposits booked for 1001 days, while general investors will receive 9.00% p.a. for the same time period. In addition, Unity Bank is providing outstanding interest rates of 9.25% p.a. to senior citizens and 8.75% p.a. to general investors for tenures of 181-201 days and 501 days.

Unity Small Finance Bank FD Rates

The bank is now giving an interest rate of 4.50% on fixed deposits that mature in 7-14 days, while Unity SFB is also offering an interest rate of 4.75% on deposits that mature in 15-45 days. Unity SFB is now providing interest rates of 5.25% on deposits with a tenor of 46 to 60 days and 5.50% on deposits with a tenor of 61 to 90 days.

Deposits with maturities between 91 and 180 days will now earn interest at a rate of 5.75%, while those with maturities between 181 and 201 days will now earn interest at a rate of 8.75%. The bank is currently giving an interest rate of 6.75% on fixed deposits that mature in the next 202–364 days, while Unity Small Finance Bank (SFB) will give an interest rate of 7.35% on deposits that mature in the next 365–500 days.

A deposit tenor of 501 days will earn interest at a rate of 8.75% from Unity Small Finance Bank (SFB), while a deposit tenor of 502 days to 18 months would earn interest at a rate of 7.35%. Deposits maturing in 18 months -1000 days will now fetch an interest rate of 7.40% and those maturing in 1001 days will now fetch a maximum interest rate of 9.00%. The bank is now giving an interest rate of 7.65% on fixed deposits maturing in 1002 days to – 5 years, while Unity SFB will also pay an interest rate of 7.00% on deposits maturing in 5 years to 10 years.

Promoted by Centrum Financial Services Ltd with Resilient Innovations Pvt Ltd as a joint investor, Unity Bank is a Scheduled Commercial Bank. Unity Bank offers one of the highest rates in the industry on savings accounts, with interest rates of 7% per year for deposits over ₹1 lakh and 6% per year for deposits under ₹1 lakh.

The Reserve Bank of India (RBI) raised the repo rate by 25 basis points to 6.50% on February 8, 2023, as part of its most recent monetary policy announcement. In response to the RBI’s increase in the repo rate, several banks, including SBI, Axis Bank, Bank of Maharashtra, DCB Bank, IDBI Bank, Fincare Small Finance Bank, Jammu and Kashmir Bank (J&K Bank), Tamilnad Mercantile Bank, and IndusInd Bank, have raised their interest rates on fixed deposits so far since RBI’s announcement.