Fixed Deposit Interest Rates: The public sector lender Central Bank of India has hiked interest rates on savings accounts and fixed deposits of less than ₹2 Cr. The bank’s official website states that the latest savings account interest rates will go into effect from 15.03.2023 and customers will get a maximum interest rate of 3.30 % per annum. Whereas the latest fixed deposit (FD) interest rates of Central Bank of India are effective as of 10.03.2023, and upon the announcement, the general public will get a maximum rate of 6.75% and senior citizens can get a maximum rate of 7.25% on their fixed deposits.

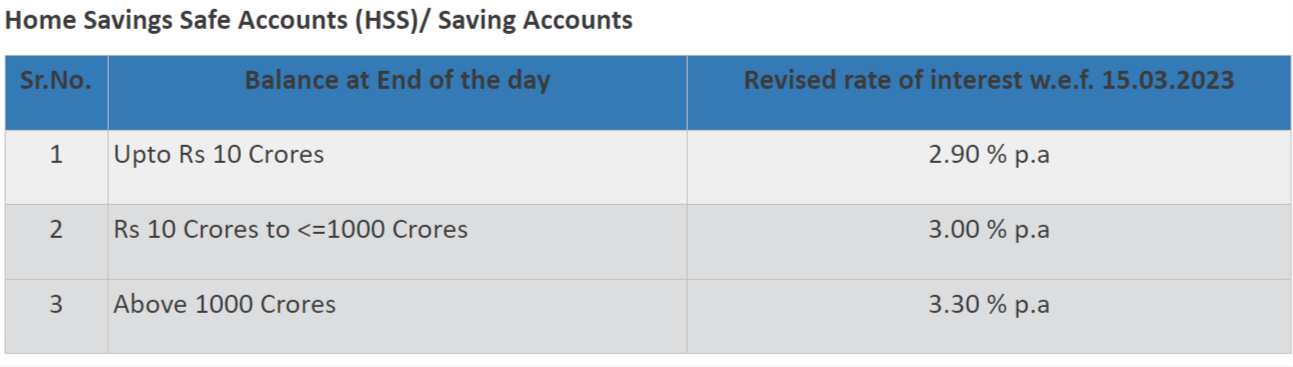

Central Bank of India Savings Account Interest Rates

On savings accounts with a daily end of the day balance of upto ₹10 Crores, the bank is promising an interest rate of 2.90 % p.a and on accounts with daily end-of-the-day balance of ₹10 Crores to less than ₹1000 Crores, Central Bank of India is now promising an interest rate of 3.00 % p.a. Central Bank of India is now promising an interest rate of 3.30 % p.a on savings accounts with daily end of the day balance of above ₹1000 Crores.

Central Bank of India FD Rates

The bank is now providing an interest rate of 4.00% on fixed deposits maturing in 7–14 days, and the Central Bank of India is also promising an interest rate of 4.25% on deposits maturing in 15–45 days. Central Bank of India is now offering interest rates of 4.50% on deposits with tenors of 46-90 days and 5.00% on deposits with tenors of 91-179 days.

Deposits with maturities between 180 and 364 days will now earn interest at a rate of 5.50%, while those with maturities between 1 year and 2 years will now pay interest at a rate of 6.75%. The bank is now offering an interest rate of 6.50% on domestic term deposits maturing in 2 years to less than 3 years, while the Central Bank of India will guarantee an interest rate of 6.25% on domestic term deposits maturing in 3 years or more and up to 10 years.

“An additional interest rate of 0.50% p.a. over and above the normal rate of interest for any of our Time Deposit Schemes & also for Tax Saver Depositors Scheme will be given as incentive for deposits of Senior Citizens who are above 60 years of age,” Central Bank of India has mentioned on its website.

Deposits made under the non-callable plan will receive an additional 0.50% in interest for senior citizens, 1% in interest for super senior citizens, 1.50% in interest for senior citizen employees, and 2.00% in interest for ex-staff super senior citizens. Jio strong plan, 84 days validity will be available in just Rs 395, calls, SMS and data will also be available for free